Strategies for resilient real estate: interview with Camille Gautier, innovation leader at Elan

4 minutes of reading

Without denying the ostensibly anxiety-provoking prospects anticipated by scientists, it proposes keys to designing a liveable and desirable future: knowing and reducing one’s vulnerabilities, learning to react to unknown phenomena, applying principles of continuity, redundancy and sobriety. How can we implement this concept and develop a methodical and operational resilience strategy at the scale of real estate projects? Insights from Camille Gautier, Innovation Leader at Elan.

3,500 victims, 13.5 million people displaced, more than 140 billion dollars in economic losses: this is the cost estimated by the British NGO Christian Aid of the 10 most costly extreme events of 2020, linked to global warming. Faced with the new climatic realities and increasingly perceptible impacts, a concept is needed to qualify the capacity of territories to continue to function independently of disturbances and by adapting now to irreversible long-term changes: climate resilience. Without denying the ostensibly anxiety-provoking prospects anticipated by scientists, it proposes keys to designing a liveable and desirable future: knowing and reducing one’s vulnerabilities, learning to react to unknown phenomena, applying principles of continuity, redundancy and sobriety. How can we implement this concept and develop a methodical and operational resilience strategy at the scale of real estate projects? Insights from Camille Gautier, Innovation Leader at Elan.

The second phase of the methodology aims to build an adaptation strategy for real estate. We set out recommendations to remedy the various risks identified, specifying a timeframe for implementing the recommendation, a level of investment and the level of impact of the recommendation on the risks it addresses. Based on the analysis of risks, recommendations and associated costs, we then establish the impact of the strategy on the market and rental value of the asset. This financial approach is carried out with a partner, based on different climate change adaptation scenarios up to 2050.

The second phase of the methodology aims to build an adaptation strategy for real estate. We set out recommendations to remedy the various risks identified, specifying a timeframe for implementing the recommendation, a level of investment and the level of impact of the recommendation on the risks it addresses. Based on the analysis of risks, recommendations and associated costs, we then establish the impact of the strategy on the market and rental value of the asset. This financial approach is carried out with a partner, based on different climate change adaptation scenarios up to 2050.

Elan, an eco-responsible real estate consultant, has been working on urban resilience for several years now and helps real estate players to take into account the impact of climate change in their projects. What were your motivations?

Droughts, storms, heat waves, floods: the number of climatic hazards and natural disasters has increased 50-fold in a century, and their frequency and intensity are expected to continue to grow, according to climate simulations. Our ways of designing and building must evolve to take account of this reality and anticipate these future developments. Indeed, the building sector is both partly responsible for global warming (it represents 26% of national greenhouse gas emissions in France) and a victim of its effects. Intensifying the uses of premises to optimise the existing, anticipating the flexibility and reversibility of structures beforehand, encouraging active mobility, limiting consumption during operation, incorporating biodiversity and the principles of the circular economy: all these factors can contribute to decarbonising projects, by limiting greenhouse gas emissions. But to work towards resilient projects, this mitigation strategy must be coupled with an adaptation strategy, with the aim of reducing the impact of climate change-related hazards.

What methodology have you developed to implement this adaptation strategy?

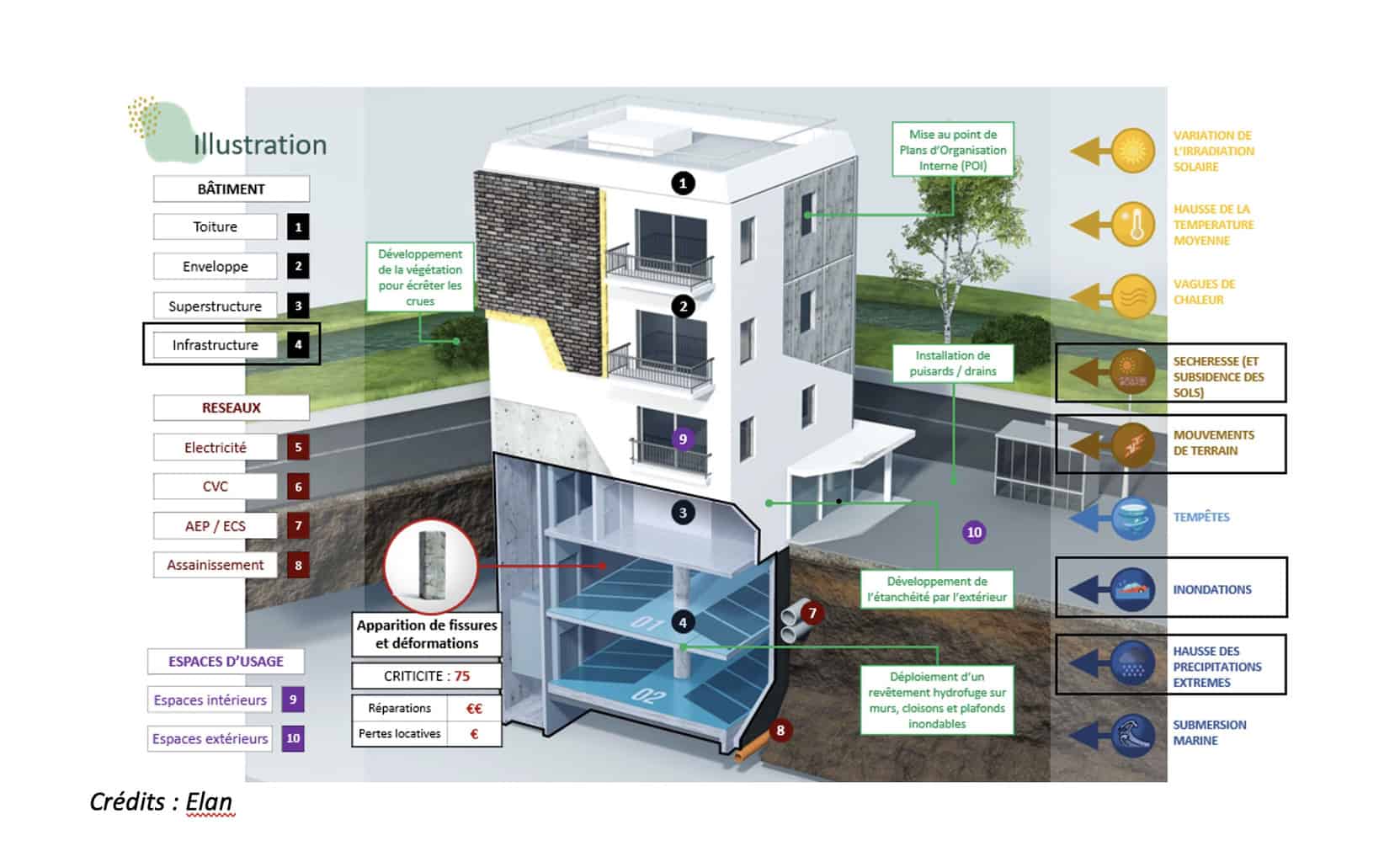

The methodology we have developed aims to assess the vulnerability of an asset to climate risks, and then to identify recommendations to help protect against them in a resilience strategy appropriate to the project. During the first diagnostic phase, we identify the climatic hazards that may impact the study site and carry out a technical inventory of the building (or an analysis of the design file if it is a new building or one to be renovated). The approach is broken down by type of space: buildings, networks and use spaces. In this way, the analysis can cover both user comfort and building performance elements, for example. The cross-referencing of climate hazard analysis and engineering design allows a risk criticality level to be established for the building under study, and then the costs of inaction (damage repair and potential loss of rent) to be assessed. The second phase of the methodology aims to build an adaptation strategy for real estate. We set out recommendations to remedy the various risks identified, specifying a timeframe for implementing the recommendation, a level of investment and the level of impact of the recommendation on the risks it addresses. Based on the analysis of risks, recommendations and associated costs, we then establish the impact of the strategy on the market and rental value of the asset. This financial approach is carried out with a partner, based on different climate change adaptation scenarios up to 2050.

The second phase of the methodology aims to build an adaptation strategy for real estate. We set out recommendations to remedy the various risks identified, specifying a timeframe for implementing the recommendation, a level of investment and the level of impact of the recommendation on the risks it addresses. Based on the analysis of risks, recommendations and associated costs, we then establish the impact of the strategy on the market and rental value of the asset. This financial approach is carried out with a partner, based on different climate change adaptation scenarios up to 2050.

Has this methodology been tested in the field?

We have implemented this methodology for two investor clients on 7 office buildings. The aim was to anticipate potential damage due to the impacts of climate change throughout the life of the buildings and to estimate the financial costs of repairs. The issues are loss of rental income, increased obsolescence, non-compliance with regulations, and therefore a high risk of devaluation of their assets. This is why we talk about financial asset enhancement. Our clients were convinced and are now planning to apply this methodology to all their future acquisitions in order to factor climate risk into their CAPEX from the start.What comes next?

As part of our quest to constantly improve the tool, we are working with a start-up partner specialising in the collection and modelling of climate data, capable of anticipating climate change over long time frames (up to 2050). This allows us to make more accurate projections than by using public data from Météo France. We also have several development perspectives. The first would be to work on the scale by transposing this methodology to the development of urban projects, and not just on the scale of one building. The second would be to adopt a more global vision of urban and territorial resilience by incorporating social, security, water, biodiversity, food and health issues and taking into account their systemic nature.More reading

Read also

What lies ahead? 7 megatrends and their influence on construction, real estate and urban development

Article

20 minutes of reading